The restaking landscape has matured significantly since its early days, and shared security is set to define crypto’s next phase formalises.

The defining edge of @symbioticfi lies in its flexible base primitive: security that adapts as markets evolve, without sacrificing composability or robustness.

We’ve already seen how this dynamic plays out with LRTs. Over time, they’ll fragment across asset classes, risk profiles & narratives:

LRTs → BTC-Fi → Yield-bearing stablecoins → RWAs & beyond

What dominates today will inevitably diversify tomorrow. That creates an opportunity for a security ecosystem that adapts across narratives instead of being locked to one asset class.

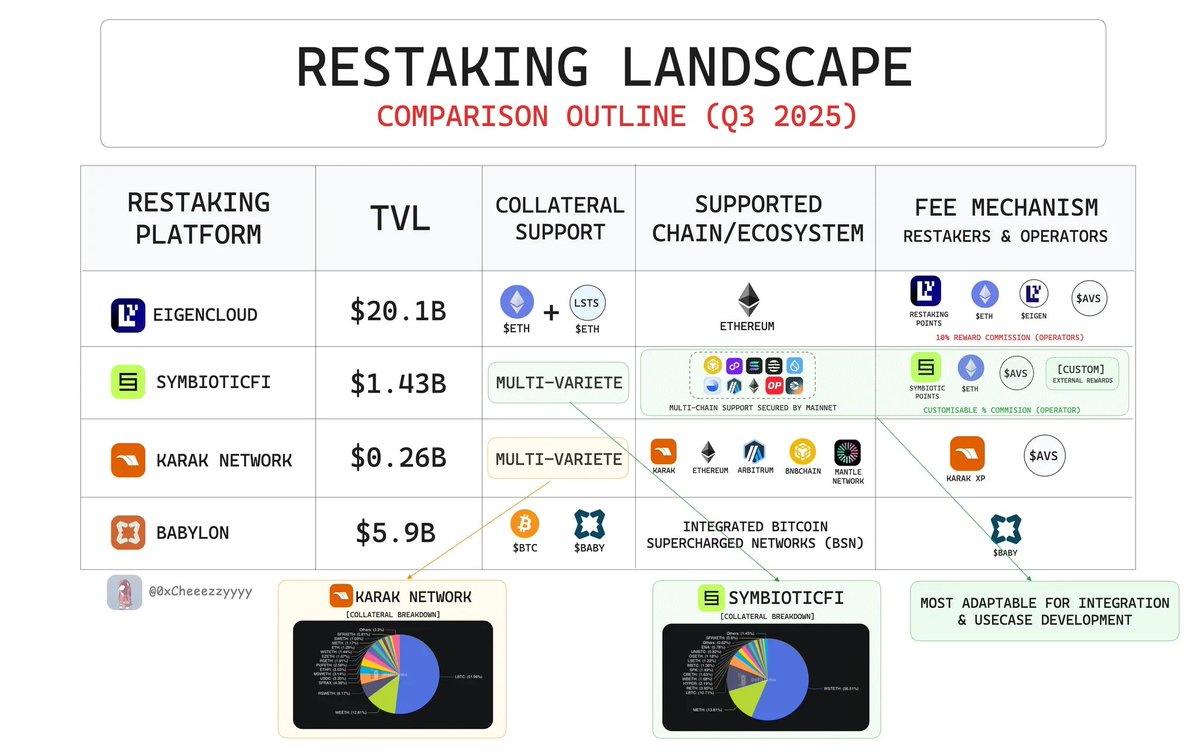

Currently, most restaking platforms are defined by their core asset:

🔸@eigenlayer → ~$20B TVL leading on ETH-based restaking (first-mover advantage, ATH TVLs)

🔸@babylonlabs_io → focused on BTC-Fi native staking with exogenous asset management

🔸@Karak_Network → gained traction as a multi-asset restaking platform during the hype wave (peaked at $1B TVL, now ~$262M)

While most platforms remain tied to a specific base, Symbiotic differentiates itself by adaptability: a modular, asset-agnostic framework designed for efficient shared security.

Case in point:

In an increasingly multi-chain ecosystem, with niche + esoteric primitives proliferating, the demand for interoperable shared security only grows.

Symbiotic’s model focus on accommodative integration + efficiency here is designed to capture this unseen but massive market gap imo.

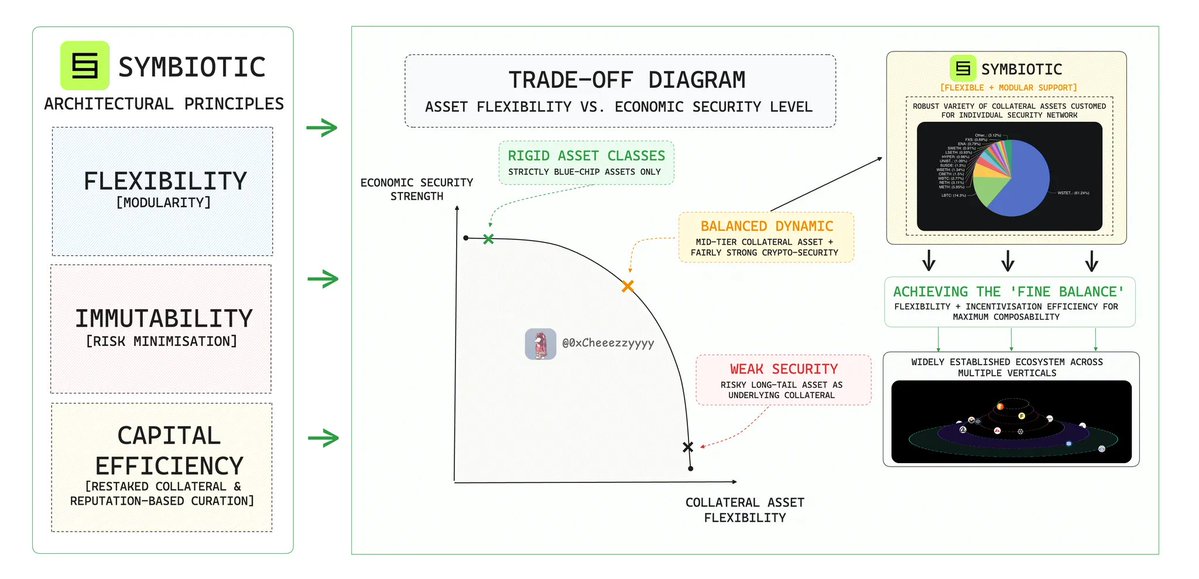

Yes, flexibility introduces trade-offs.

Strict security guarantees can be harder to enforce. But in crypto, this is a double-edged tool:

1. Stability doesn’t come from rigidity

2. It comes from permissionless adaptability

Just as decentralisation gains strength from openness, Symbiotic thrives by making composability a first-class property.

--------

On Max Efficiency Incentivisation

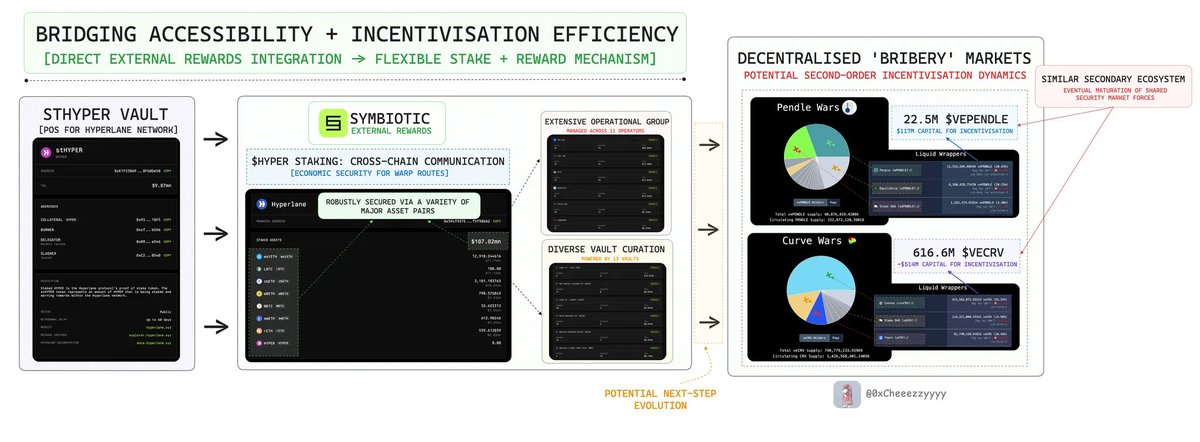

Symbiotic’s adaptability is further highlighted by its newest primitive: External Rewards.

Protocols can now incentivise stakers, operators & contributors directly with their own native tokens.

This skips any tedious, bespoke infra setups. Instead, protocols get a direct pipeline for incentivisation: plug into the shared layer and bootstrap trustless security from day one.

And it’s already live in production demonstrating effectiveness:

🔹@hyperlane → $HYPER rewards for Warp Route security.

🔹 @sparkdotfi → $SPK staking + Spark Points.

🔹 @cyclenetwork_GO → native incentives for multichain settlement.

And many more protocols like @TanssiNetwork @Ditto_Network @KalypsoProver @primev_xyz @OmniFDN →all plugged into Symbiotic’s reward engine.

But imo, the real unlock is in second-order effects.

Think back to one of the most prominent incentivisation landscape DeFi pioneered: @CurveFinance veCRV lockups → protocols bribed lockers to steer liquidity.

As the Curve ecosystem matured, liquid lockers (@ConvexFinance, @StakeDAOHQ, @yearnfi) entered with $514M veCRV stake → abstracting complexity, compounding rewards & driving efficiency.

The same applied to @pendle_fi’s vePENDLE landscape shaped up with , amounting to ~$117M 'incentivisation-locked' capital.

Symbiotic’s External Rewards here allows for the same dynamics, but to security instead of liquidity.

Now, protocols openly compete to attract stakers/operators. This creates market-based pricing of ‘who secures what’ the foundation of a security marketplace.

This may be abit of a far-fetched idea, but expect potential meta-protocols to emerge:

🔸Reward aggregators

🔸Influence markets

🔸Liquid wrappers (for rewards)

Just as liquidity was financialised in DeFi 1.0, security is about to be financialised in modular DeFi.

TLDR: External Rewards set the foundation for a more efficient, composable & ultimately financialised shared security marketplace.

--------

Pairing Efficient Market Forces with Multivariate Coordination

External Rewards introduce the economic engine for efficient incentive markets for robust shared security.

But incentives are only one side of the equation, the other side is coordination.

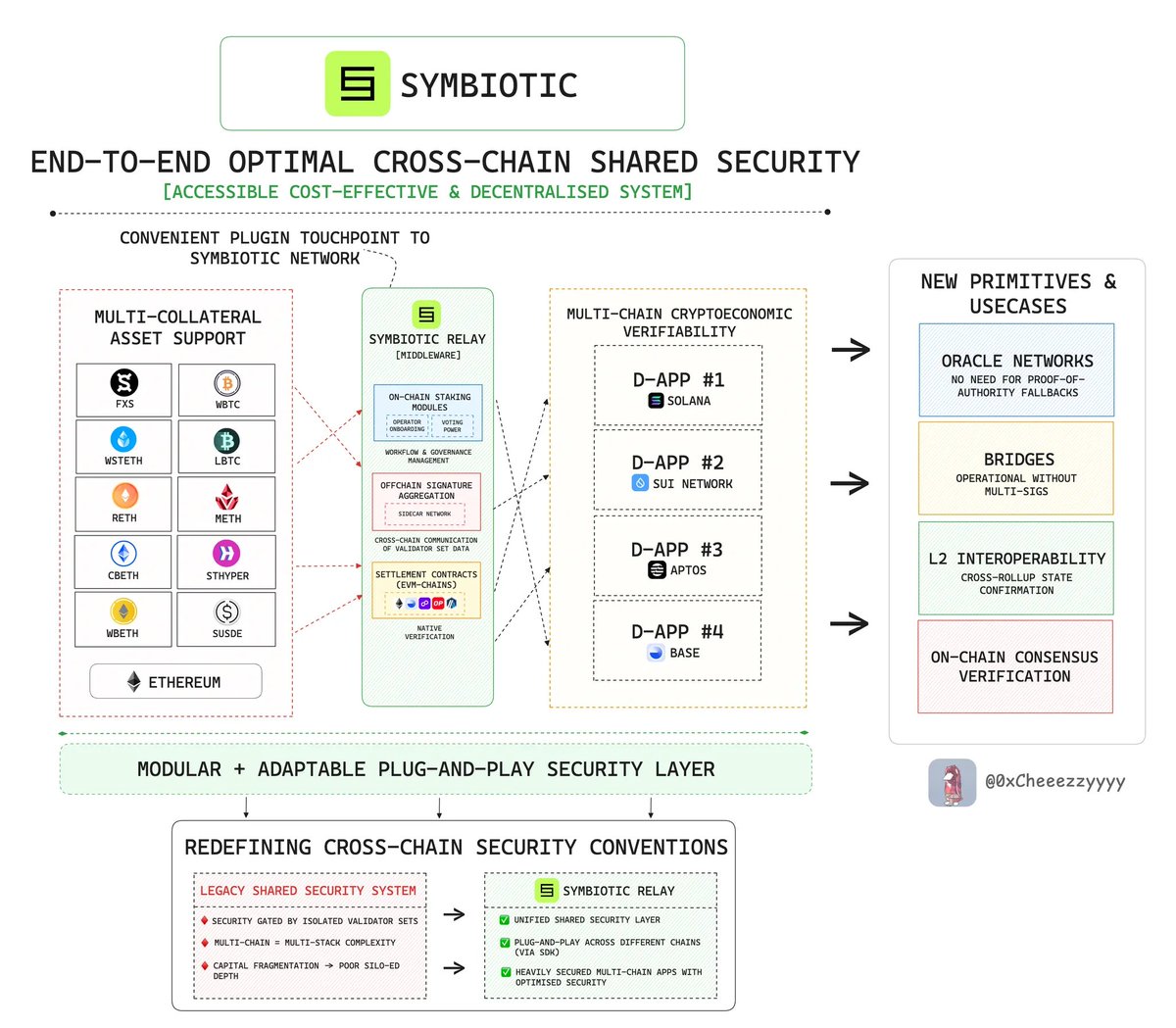

If External Rewards solve who pays for security, Relay solves how it scales.

From a technical PoV, Symbiotic’s architecture rests on three principles:

1⃣Flexibility → plug into evolving assets & narratives.

2⃣Immutability → predictable rules, reducing governance risk.

3⃣Capital efficiency → maximum security per unit of capital.

it's modular design separates stakeholders into a composable plug-and-play stack, enabling end-to-end configurations for shared security.

The recent launch of Symbiotic Relay takes this up even further.

It serves as a base layer for multichain security coordination. Through a simple SDK, protocols can secure core infra (bridges, rollups, oracles etc. you name it) with mainnet’s stake, verified across chains.

For the first time, the idea of 'shared security' becomes:

🔸Composable → a shared cryptoeconomic layer.

🔸Interoperable → verifiable across multiple chains.

🔸Efficient → no bespoke validator silos or central relayers.

This is modular crypto’s missing piece: efficient, multivariate coordination across sovereign networks.

The biggest value proposition here is that it exponentially expands the design space for new use cases, something no other restaking platform currently offers.

--------

Final Thoughts

Ok I have yapped a fair bit, but here's my gist.

Symbiotic is entering steady-state maturity while opening the door to exponential growth:

🔸 $1.43B+ staked

🔸 Securing 15+ production networks

External Rewards layer incentives directly onto this base, and Relay unlocks verifiability across chains.

Together, they make Symbiotic the economic coordination layer for modular infrastructure.

Zooming out on the bigger picture:

Decentralised systems demand shared, democratised access to security. Just as cloud computing abstracted complexity to unlock internet scale, Symbiotic abstracts trust to unlock crypto scale.

The next wave of modular infra won’t just compete for liquidity, it will compete for security, trust & coordination imo.

And Symbiotic is fast becoming the marketplace where those forces converge.

External Rewards are now live on @symbioticfi.

Earn native incentives, including token rewards, from leading networks directly through Symbiotic.

9.72K

54

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.